Pricing the iPad Mini

Tomorrow the iPad Mini will be announced. While we already know almost everything about the device due to supply chain leaks, the one thing we don't know is the price. The two main forces to balance when pricing a product are the competitive landscape and the profit margin.

Competitive Landscape

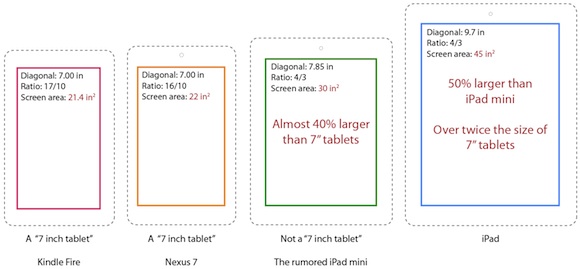

Google and Amazon are the most worthy competitors in the small tablet market. Google's Nexus 7 is $199 and Amazon's Kindle Fire HD is also $199 (albeit with ads). The 7" tablet battle is clearly happening around the $199 price point. But Apple is not making a 7" tablet, they are making a 7.85" tablet. In other words, the iPad Mini's value proposition is not "the best 7 inch tablet ever made". Instead, it is "7 inches is too small, so we made ours bigger, and it's the best small tablet ever made". Trojan Kitten created an excellent illustration of the difference.

The iPad Mini's screen will be nearly 40% larger than the Kindle Fire HD and Nexus 7. If this same 40% is crudely applied to their $199 price point, you get an estimated iPad Mini price of $279.

Profit Margins

Apple has repeatedly shown that they are willing to cannibalize their own products. Famously, they cannibalized iPod with iPhone and Mac with iPad. As readers know, I am a big fan of disruption theory, and this is again a lesson in disruption: you would rather cannibalize yourself than allow a competitor to do it. When you cannibalize yourself, the customer still walks out of the store with an Apple product - it's just a different one.

Studying Apple's past cases of self cannibalization can teach us important lessons about disruption and Apple's use of the theory. In this case, the most important lesson is that the new product maintains or increases profit margins. The iPhone has greater profits margins than the iPod, and the iPad has greater profit margins than the Mac. Therefore we can ask the question: At what price point does the iPad Mini maintain or increase profit margins?

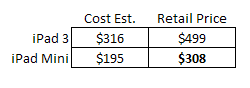

To do this, we need to know the margins of the iPad, and the cost to build an iPad Mini. Those numbers are not disclosed by Apple, so we will have to use implied margins as a proxy. Implied margins are simply the retail price minus the manufacturing costs. KGI securities analyst Ming-Chi Kuo has estimated the cost of the iPad Mini at $195. Before finding Kuo's estimate, I used component costs from the iPad 2 and iPhone 5 to construct my own estimate and arrived at $203. Pretty close. Since Kuo does this "professionally", we'll use his estimate of $195. For the iPad 3, we have iSuppli's estimate of $316. Here's a table:

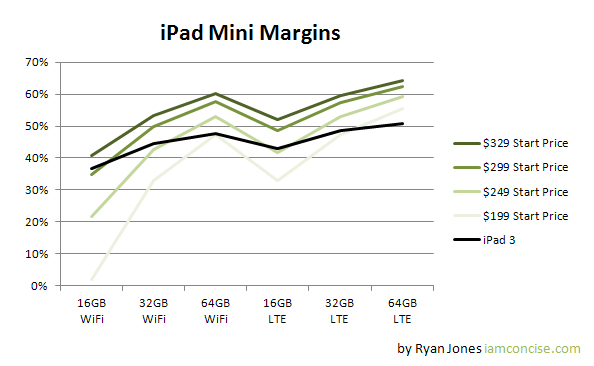

Simple cross multiplying yields an expected price of $308 (very similar to our earlier estimate of $279). However, we know that the base model has the lowest margins, and not everyone buys the base model. So we need to look at margins across the entire iPad portfolio to see a more realistic distribution of margins.

The $199 starting price has margins below that of the iPad 3 in every model except for the most expensive. This starting price would not adequately maintain the iPad 3's profit margin.

Alternatively, $329 starting price aggressively increases the profit margins, almost too much.

The $299 starting price has margins at or above every model of the iPad 3, and almost exactly matches on the always important base model. Including our previously calculated price estimates of $279 and $308, $299 fits in quite nicely. It maintains margins at the lowest price point, and healthily increases margins on every other model. $299 seems like the clear choice.

However, it's not exactly "case closed" when you study the $249 starting price curve. The base model provides an appealing low entry price point, and is conveniently the only point which sacrifices margins. A starting price of $249 would signal that Apple has placed added importance on a low entry price point.

Oct 22, 2012 |

Oct 22, 2012 |  Permalink

Permalink